Reading an insurance card can feel confusing and overwhelming, but it’s important to understand.

Being able to locate key information on your card helps you access maximum benefits and simplifies the process of seeking medical care.

This knowledge can save you time, prevent billing errors, and clarify what services are covered.

Familiarizing yourself with these details empowers you to make informed decisions about your healthcare.

What’s On Your Insurance Card

Your insurance card contains valuable information that helps you and healthcare providers understand your coverage.

Although the layout and details vary from one insurance provider to another, there is specific information that most cards share.1

When trying to find out how to read an insurance card, look for these key details:

- Personal Information

- Policy Number or Member ID

- Group Number

- Copays

- Type of Insurance (e.g., PPO, HSA)

- Provider Contact Information

Start Your Recovery Journey with Cornerstone

Explore residential, outpatient, and virtual pathways to mental health recovery in Arizona.

Personal and Policy Details

Your insurance card holds important personal and policy-related information that helps identify you as the policyholder and allows healthcare providers to verify your coverage.

Here’s are some key details you should know when learning how to read an insurance card.

Personal Information

Your card will contain basic personal information, such as name, address, and date of birth.

Healthcare providers use this information to verify your identity, making sure the claims go through correctly.2

Policy Number and Member ID

The policy number or member ID is a unique identifier for your insurance plan, usually found on your card.

This helps healthcare providers verify your coverage and process claims.

Most of the time, the policy number and the member ID are one and the same.

Group Number

If you have employer-provided insurance, your card will also have a group number.

The insurers use this number to determine the exact plan, which is important for handling billing and processing claims.

Plan and Coverage Information

Your insurance card outlines the type of plan you have and the costs you may incur when accessing healthcare services.

Understanding these details can help you manage your care more efficiently.

Copay Information

Your copay amount is a fixed fee for different types of healthcare services, which will be clearly indicated on the insurance card.

These can vary for visits to your Primary Care Physician (PCP), specialists, or emergency room care.

Type of Insurance (PPO, HSA, etc.)

When learning how to read an insurance card, familiarize yourself with where the type of plan is located.

This section of your card will give you more information about your insurance policy.3

Here’s a quick breakdown of the common plan types and what they mean :

- PPO (Preferred Provider Organization): Flexibility to see any doctor but lower costs in-network.

- HMO (Health Maintenance Organization): Requires choosing a primary care physician and getting referrals for specialists.

- HSA (Health Savings Account): Paired with high-deductible plans, allowing tax-free savings for medical expenses.

Checking Your Benefits Before an Appointment

You must review your insurance card before arriving to receive medical care to avoid unexpected costs.

Here’s some information that can help you better prepare:

- First, check copays, covered services, and the type of plan to understand your out-of-pocket costs.

- Ensure the provider is in-network to minimize costs.

- Confirm if a referral is required for specialist visits

- Contact customer service for any questions about coverage.

Provider and Contact Information

Information about your provider, including contact information, is often on the back of the card.

This will include the customer service numbers and websites to help you answer questions you may have, such as:

- Benefits

- Claims

- In-Network Providers

Keep this information handy to ensure you can get the assistance you need in a timely manner.

Quick Tip: Verify Your Benefits First to Save Time & Money!

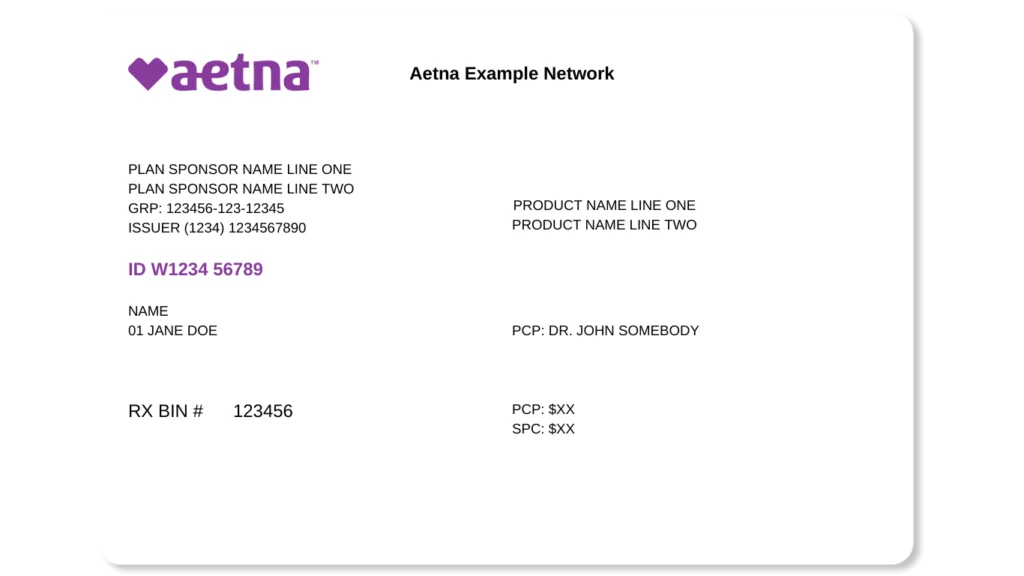

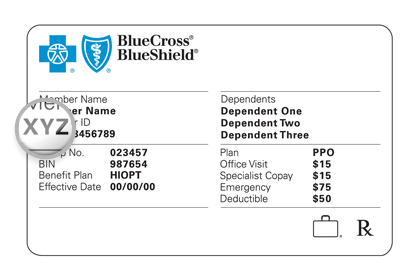

Different Providers Have Different Cards

While each insurance card looks a little different from carrier to carrier, they all carry important information needed for healthcare coverage.

Here’s what you’ll typically find, no matter the design:

- Personal information: Includes your name and, at times, address or date of birth.

- Policy number and member ID: Identifiers specific to your specific plan.

- Group Number: Only applies to employer-based plans; this identifies your group coverage.

- Copay Amounts: Fixed fees for various services like doctor visits or prescriptions.

- Type of Plan( PPO, HMO, etc.): Indicates the kind of plan you have and how it covers care.

If you find the layout or details on your card confusing, reach out to your insurance provider to clarify what exactly it entails to make sure you’re covered when seeking care.

Below Are Examples of How to Read an Aetna Insurance Card vs. BlueCross BlueShield Insurance Card:

Frequently Asked Questions

Is the policy number the same as my member ID?

What is PPO?

What is PCP?

What is a copay?

Where is my policy number located?

Key Takeaways

- Key Takeaways

- Know where to find key details like your policy number, group number, and copay amounts on your card.

- Familiarize yourself with your plan type (PPO, HMO, HSA) as it affects provider options and costs.

- Look for provider contact information to clarify benefits or handle claims questions.

- Remember, different providers design their cards differently, but the essential details remain similar.

- Understanding your insurance card can help you maximize benefits and avoid confusion in healthcare settings.

Navigating Your Insurance Card with Confidence

Understanding how to read an insurance card can help you make informed decisions about your healthcare while avoiding unnecessary surprises.

By knowing important details on your insurance card, such as your policy number, copays, and plan type, you can feel more prepared for medical appointments.

If you ever feel uncertain about your coverage, remember that support is available.

At Cornerstone Healing Center, we accept a variety of insurance plans to help you access the substance abuse treatment and mental health services you need.

We also offer free insurance verification to help you understand your coverage and ensure you get the care you deserve.