As a Banner Health employee, you have access to important information about your substance abuse treatment coverage through various employer health plans, including VALUE, PREMIER, and CHOICE PLUS.

This article aims to equip you with the knowledge you need about your Banner Employee Health Insurance Substance Abuse Coverage, ensuring you can make the best decisions for your recovery and well-being.

Please note that the information provided is current as of this writing and may change at any point in the future.

Key takeaways

- Diverse Plan Options: Banner Health offers three distinct health plans - VALUE, PREMIER, and CHOICE PLUS - each with unique benefits and coverage levels for substance abuse treatment, catering to a variety of needs and circumstances.

- Financial Aspects of Coverage: Each plan comes with specific deductibles and out-of-pocket costs. Understanding these financial implications is crucial for you to manage the expenses associated with substance abuse treatment effectively.

- Eligibility Criteria: Familiarize yourself with the eligibility criteria and pre-authorization requirements for substance abuse treatment under each Banner Health plan, ensuring smooth access to necessary services.

- Comprehensive Treatment Coverage: Banner Health's health plans cover a wide range of substance abuse treatments, including inpatient and outpatient services, counseling, and therapy, offering comprehensive support for recovery.

- Coverage Limitations: Be aware of the limits and restrictions in your plan, such as caps on sessions, duration, or types of treatments not covered, to avoid unexpected challenges during your treatment journey.

- Support Resources: Banner Health provides extensive support through insurance assistance and external resources, helping you navigate the complexities of substance abuse treatment coverage.

✅

Is substance abuse treatment covered for Banner Health employees? Yes, Banner Health provides coverage for substance abuse treatment to its employees, with specific details depending on the chosen health plan, including VALUE, PREMIER, and CHOICE PLUS.

Detailed Comparison of Banner Health Insurance Plans

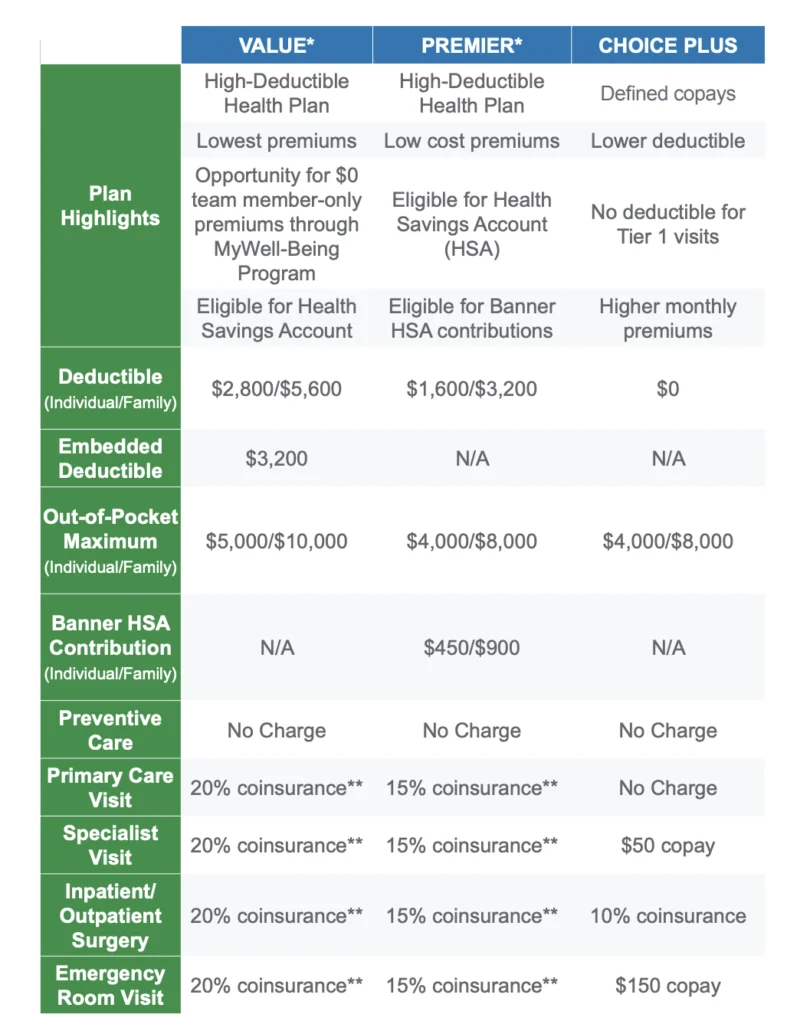

Banner Health offers three main health insurance plans, tailored to meet the diverse needs of its employees, including specific provisions for Banner health drug rehab and substance abuse treatment.1

These plans are VALUE, PREMIER, and CHOICE PLUS.

Below is an overview of each plan:

VALUE Plan:

• The VALUE plan is tailored for those seeking essential coverage at a more affordable cost.

• It typically offers lower premiums but comes with higher deductibles and

• This plan suits employees who do not anticipate frequent medical services but want protection against high-cost medical events.

• The VALUE plan might cover basic services for substance abuse treatment but with higher co-payments or coinsurance rates.

PREMIER Plan

• The PREMIER plan is designed for employees seeking a balance between cost and coverage.

• It generally offers moderate premiums with lower deductibles than the VALUE plan.

• This plan might be ideal for employees who expect moderate healthcare needs and desire broader coverage, including more comprehensive substance abuse treatment options.

• The PREMIER plan often includes better coverage for specialized substance abuse services, such as intensive outpatient programs or advanced therapy sessions.

CHOICE PLUS Plan:

• The CHOICE PLUS plan is the most comprehensive option, offering the broadest range of coverage with higher premiums and the lowest deductibles.

• It is well-suited for employees anticipating frequent medical care or requiring extensive healthcare services.

• This plan often provides the most extensive coverage for substance abuse treatments, including inpatient rehabilitation, outpatient services, and extended therapy options.

• Employees under the CHOICE PLUS plan may benefit from lower out-of-pocket costs for substance abuse treatments and greater flexibility in choosing providers.

💰

Does Banner Health impose any deductibles for its health plans? Yes, Banner Health’s health plans, including VALUE, PREMIER, and CHOICE PLUS, each come with specific deductible amounts that vary based on the chosen plan.

Plan Highlights and Deductibles

Understanding the highlights and deductibles of each Banner Health insurance plan is essential for making informed decisions about your healthcare, especially when considering substance abuse treatment.

Here’s a concise snapshot of the VALUE, PREMIER, and CHOICE PLUS plans:

VALUE Plan:

Key Features: Designed for cost-saving, this plan offers essential coverage at more affordable premiums. It’s ideal for employees expecting minimal medical care.

Deductibles:

• Individual: Higher individual deductible, suitable for those with fewer healthcare needs.

• Family: Family deductible aligns with the plan’s focus on affordability but may be higher than other plans.

PREMIER Plan:

Key Features: A middle-ground option, the PREMIER plan balances cost with coverage. It offers more comprehensive coverage than the VALUE plan with moderately priced premiums.

Deductibles:

• Individual: Moderate individual deductible, reflecting the plan’s balance between cost and coverage.

• Family: Family deductible is lower than VALUE but higher than CHOICE PLUS, catering to families with moderate healthcare needs.

CHOICE PLUS Plan:

Key Features: This is the most comprehensive plan, offering extensive coverage with the highest premiums and lowest deductibles. It’s tailored for those with significant healthcare needs or who desire the broadest coverage.

Deductibles:

• Individual: Lowest individual deductible among the three plans, catering to those requiring frequent healthcare services.

• Family: Family deductible is significantly lower, reflecting the plan’s emphasis on comprehensive coverage.

🧾

What are the out-of-pocket costs for Banner Health’s insurance plans? Out-of-pocket costs under Banner Health’s insurance plans, such as VALUE, PREMIER, and CHOICE PLUS, vary, including deductibles, co-pays, and maximums, depending on the specific plan selected.2

Out-of-Pocket Costs and Care Specifics

For Banner Health employees considering substance abuse treatment, understanding the out-of-pocket costs and specifics of care under each health plan is crucial.

This includes knowledge about out-of-pocket maximums, Health Savings Account (HSA) contributions, and costs associated with various types of care.

Here’s an overview for the VALUE, PREMIER, and CHOICE PLUS plans:

VALUE Plan:

• Out-of-Pocket Maximums: Typically the highest among the three plans, providing a cap on the maximum amount you’ll pay in a year.

• HSA Contributions: Eligibility for HSA contributions, which can be used to offset higher out-of-pocket costs.

Costs for Various Types of Care:

• Preventive Care: Generally covered at low or no cost.

• Primary Care: Higher co-pay or coinsurance compared to other plans.

• Specialist Visits: Higher costs for specialist care, including substance abuse specialists.

• Surgery and Emergency Room Visits: Higher out-of-pocket costs, reflecting the plan’s higher deductibles and maximums.

PREMIER Plan:

• Out-of-Pocket Maximums: Moderately set to balance between coverage and cost.

• HSA Contributions: May offer HSA options but with less emphasis compared to the VALUE plan.

Costs for Various Types of Care:

• Preventive Care: Usually covered at no extra cost.

• Primary Care: Moderate co-pay or coinsurance.

• Specialist Visits: More affordable than VALUE for specialty care, including substance abuse treatment.

• Surgery and Emergency Room Visits: More reasonable costs compared to VALUE, reflecting the plan’s balance.

CHOICE PLUS Plan:

• Out-of-Pocket Maximums: The lowest among the plans, minimizing your yearly

• HSA Contributions: While offering comprehensive coverage, HSA options might be limited due to lower out-of-pocket expenses.

Costs for Various Types of Care:

• Preventive Care: Usually covered fully.

• Primary Care: Lower co-pay or coinsurance.

• Specialist Visits: Lower costs for specialists, ideal for regular substance abuse treatment sessions.

• Surgery and Emergency Room Visits: Significantly lower costs compared to the other plans.

🤔

How do I know if my substance abuse treatment requires pre-authorization under my Banner Health plan? It’s advisable to consult your plan’s documentation or contact the insurance provider directly to determine if your specific substance abuse treatment requires pre-authorization.

Eligibility for Substance Abuse Treatment Coverage

Understanding the eligibility criteria and pre-authorization requirements for substance abuse treatment is a critical aspect for Banner Health employees when evaluating their healthcare plans.

While specific details can vary, here’s a general overview for the VALUE, PREMIER, and CHOICE PLUS plans:

VALUE Plan:

• Eligibility Criteria: Coverage for substance abuse treatment under the VALUE plan may be more restrictive compared to other plans. Employees might need to demonstrate medical necessity through clinical evaluation.

• Pre-Authorization Requirements: This plan likely requires pre-authorization for most, if not all, types of substance abuse treatments. This means obtaining approval from the insurance provider before commencing treatment, ensuring that the services are covered.

PREMIER Plan:

• Eligibility Criteria: The PREMIER plan typically offers broader eligibility for substance abuse treatments. Employees might still need a clinical assessment but may have more flexibility in qualifying for coverage.3

• Pre-Authorization Requirements: Pre-authorization is often required, especially for specialized treatments or inpatient care. However, the process may be more streamlined compared to the VALUE plan, reflecting the plan’s balance between accessibility and cost.

CHOICE PLUS Plan:

• Eligibility Criteria: As the most comprehensive plan, CHOICE PLUS generally has the most lenient eligibility criteria for substance abuse treatment. It may cover a wider range of treatment options and potentially include services that are not covered under other plans.

• Pre-Authorization Requirements: While pre-authorization might still be necessary, particularly for expensive or extensive treatments, the process is often more flexible. This plan may also allow for quicker approvals given its emphasis on comprehensive coverage.

Limits and Restrictions

When it comes to substance abuse treatment coverage under Banner Health insurance plans, it’s important to be aware of the various limits and restrictions that may apply.

These can include caps on the number of sessions, limitations on treatment duration, and exclusions on certain types of treatments.

Here’s how these aspects generally play out across the VALUE, PREMIER, and CHOICE PLUS plans:

VALUE Plan:

• Session Caps: This plan may have the most stringent caps on the number of covered therapy or counseling sessions.

• Duration Limits: Inpatient treatment coverage might be limited to a shorter duration compared to other plans, with strict guidelines on extensions.

• Treatment Type Exclusions: Certain types of treatments, especially those considered experimental or less traditional, might not be covered.

PREMIER Plan:

• Session Caps: There may still be caps on therapy sessions, but they are likely to be more generous than the VALUE plan.

• Duration Limits: The duration of covered inpatient treatment could be longer than VALUE but may still have certain restrictions.

• Treatment Type Exclusions: While offering broader coverage, some specialized treatments might not be included, or may require additional justification for coverage.

CHOICE PLUS Plan:

• Session Caps: This plan typically offers the highest number of covered sessions for therapy and counseling, reflecting its comprehensive coverage.

• Duration Limits: Inpatient treatment durations are generally more flexible, with potential for extensions based on medical necessity.

• Treatment Type Exclusions: CHOICE PLUS is likely to cover a wider array of treatment modalities, including some newer or specialized treatments, though some exclusions may still apply.

💑

Is family counseling covered as part of substance abuse treatment in Banner Health insurance plans? Family counseling is often covered as part of substance abuse treatment, especially under the PREMIER and CHOICE PLUS plans, but the extent of coverage can vary, so it’s important to check your specific plan details.

Types of Substance Abuse Treatments Covered

Under Banner health employee substance abuse benefits, the insurance plans typically cover a range of treatments, including inpatient services, outpatient services, counseling, and therapy.

The extent and nature of this coverage can vary significantly between the VALUE, PREMIER, and CHOICE PLUS plans.

Here’s an in-depth look at how each plan typically handles these treatment types:

VALUE Plan:

• Inpatient Services: Coverage may be more limited compared to other plans. It might cover a basic level of inpatient care, but with higher co-payments or coinsurance and possibly a shorter duration of stay.

• Outpatient Services: Outpatient care, such as regular counseling or therapy sessions, is typically covered. However, there may be limits on the number of sessions or types of therapies covered.

• Counseling and Therapy: Coverage for counseling and therapy is usually included but might be subject to more stringent caps on the number of sessions or types of counseling techniques.

PREMIER Plan:

• Inpatient Services: Offers broader coverage for inpatient treatments compared to the VALUE plan. This might include a wider range of facilities or longer treatment durations with more manageable out-of-pocket costs.

• Outpatient Services: Provides good coverage for outpatient care, including regular counseling sessions and various forms of therapy, with more flexibility in terms of the number of sessions and types of therapy.

• Counseling and Therapy: Generally includes comprehensive coverage for different counseling and therapy modalities, supporting a broader range of substance abuse treatment approaches.

CHOICE PLUS Plan:

• Inpatient Services: This plan usually offers the most extensive coverage for inpatient services, including stays at specialized facilities, with the lowest co-payments and longest permissible treatment durations.

• Outpatient Services: Highly flexible and extensive coverage for outpatient care, including a wide range of therapy options and more frequent counseling sessions.

• Counseling and Therapy: Typically covers the widest array of counseling and therapy options, including emerging and specialized treatment modalities, with the least restrictions on frequency and duration.

Navigating Your Path to Wellness with Banner Health Benefits

Understanding your Banner Health insurance plan is vital when considering substance abuse treatment.

It enables you to make informed decisions about your healthcare, effectively navigate the various drug rehab options available through Banner Health, and thoroughly assess your substance abuse treatment coverage.

Additionally, being well-informed about your plan allows you to maximize the use of employee benefits related to substance abuse.

With this knowledge, you are better equipped to embark on a path toward recovery and wellness, confidently utilizing the resources and support available to you through your Banner Health benefits.

Additional Resources

For more details on your specific Banner Employee Health Insurance Substance Abuse Coverage, please explore the resources available through the following links:

Banner Health Insurance is Welcomed at Cornerstone Healing Center in Arizona!

To better understand how your Banner Health benefits apply to your situation and receive personalized assistance, you can contact us at Cornerstone Healing Center.

Our dedicated team can verify your Banner Health benefits and offer a free treatment consultation, helping you find the right path to recovery and wellness.

For additional info, please explore our Health Insurance section, where you can discover the various other insurance types we accept and more!