Cornerstone

Understanding Cigna Drug Treatment Coverage

Learn about using your Cigna insurance policy to cover substance abuse treatment

Alcohol and Drug Treatment Coverage with Cigna

If you or a loved one is struggling with alcohol or drug addiction, you may be considering treatment options and wondering what your Cigna insurance plan covers.

Navigating the complexities of insurance can feel overwhelming, especially during such a challenging time, but understanding your coverage is crucial in accessing the care you need.

In this guide, we’ll explain the key aspects of Cigna’s alcohol and drug treatment coverage, including the types of plans available, in-network and out-of-network providers, the claims approval process, deductibles, and options for those facing financial hardship.

By familiarizing yourself with these details, you’ll be better prepared to make informed decisions about your treatment and take the necessary steps toward recovery, supported by your Cigna plan.

Jump to the following sections

View our addiction treatment locations

Addictions we treat at Cornerstone

When considering drug treatment, one of the first decisions you’ll make is whether to choose an in-network or out-of-network provider under your Cigna plan.

In-network treatment centers contract with Cigna, which often means lower out-of-pocket costs and streamlined claim processing. Cigna has a wide network of trusted providers that ensures you have access to quality care.

However, it’s important to note that not all treatment centers are in-network, so your choice may be limited. If you have a specific facility in mind, it’s crucial to check with Cigna to confirm whether it’s in-network and to understand any potential limitations in coverage.1

Opting for an out-of-network drug treatment center means the provider has no contract with Cigna. While this gives you more flexibility in choosing a facility, there are some potential drawbacks.

Out-of-network providers often have higher out-of-pocket costs, and you may need to pay upfront and submit claims for reimbursement. Out-of-network facilities may meet quality standards different from those of in-network providers.

If you find a treatment center that aligns with your specific needs and preferences and are willing to navigate the potential extra costs and paperwork, going out-of-network might be the right choice for you. Be sure to communicate with Cigna to understand your coverage and any requirements for out-of-network care.

Health Maintenance Organization (HMO)

Cigna’s HMO plans typically require choosing an in-network primary care physician to coordinate your care and refer you to specialists when needed.

While HMOs often have lower monthly premiums and out-of-pocket costs, they generally don’t cover out-of-network care except in emergencies, limiting your flexibility in choosing drug treatment providers.2

Preferred Provider Organization (PPO)

PPO plans offer more flexibility than HMOs. They allow you to see both in-network and out-of-network providers without a referral.

However, staying within Cigna’s network typically results in lower out-of-pocket costs. If you prioritize having a wider range of drug treatment options, a PPO plan might be a good fit, but be prepared for potentially higher monthly premiums.

Exclusive Provider Organization (EPO)

EPO plans are similar to HMOs in that they typically don’t cover out-of-network care except for emergencies.

However, unlike HMOs, EPOs generally don’t require referrals to see specialists within the network.

If you’re comfortable with the in-network drug treatment options available and want to balance lower costs with some flexibility, an EPO plan could be a viable option.

Cigna's Open Access Plus (OAP)

Cigna’s Open Access Plus (OAP) plan offers extensive provider access without the need for referrals to see specialists. This plan allows members to choose any healthcare provider, both in-network and out-of-network, though using in-network providers will result in lower out-of-pocket costs. While selecting a primary care provider (PCP) is recommended to help coordinate care, it is not mandatory.

The plan includes coverage for emergency and urgent care services, ensuring that members have access to necessary medical attention at any time. OAP plans are designed to provide flexibility and extensive coverage options for individuals who want broad access to healthcare providers without the need for specialist referrals.

High Deductible Health Plan (HDHP)

HDHPs typically have lower monthly premiums but higher deductibles than other plan types.

With an HDHP, you’ll pay more out-of-pocket for care until you meet your deductible, after which your plan will start sharing costs.

HDHPs are often paired with a health savings account (HSA), which allows you to set aside pre-tax dollars for medical expenses.

If you’re generally healthy and want to save on monthly premiums, an HDHP could be a good choice, but be prepared for higher upfront costs if you need drug treatment.

Medicaid & Medicare Plans

Cigna’s Medicare plans, available to those 65 or older, offer coverage for drug and alcohol treatment.

The extent of coverage varies by plan type:

- Original Medicare (Part A and B) with Cigna Supplemental Coverage:

Covers inpatient and outpatient substance abuse treatment, with Medigap plans helping to cover out-of-pocket costs. - Cigna Medicare Advantage (Part C) Plans:

Bundle Part A and B coverage, including inpatient and outpatient drug and alcohol treatment, often with Part D prescription drug coverage for medications used in substance abuse treatment. - Cigna Medicare Part D Prescription Drug Plans: These are standalone plans that can be paired with Original Medicare or Cigna Medicare Supplement plans to cover medications used in drug and alcohol treatment.3

Understanding Policy Terminology

Regarding your Cigna drug treatment coverage, the deductible is the amount you’ll need to pay out-of-pocket before your insurance plan begins to share the costs of your care.

The deductible amount can vary depending on the metal tier of your plan (Bronze, Silver, or Gold). Bronze plans typically have the highest deductibles, while Gold plans have the lowest.

For example, if you have a Bronze plan with a $1,000 deductible, you’ll be responsible for paying the first $1,000 of your covered drug treatment expenses.

Once you’ve met your deductible, your plan will start covering some of the costs, subject to any coinsurance or copayments.

Reviewing your specific plan’s deductible and understanding how it applies to drug treatment services to help you budget for your care is essential.

Co-insurance is the percentage of covered drug treatment costs you’ll share with your Cigna plan after you’ve met your deductible.

The co-insurance percentage can also vary based on your plan’s metal tier. Bronze plans generally have higher co-insurance percentages, meaning you’ll pay a larger portion of the costs, while Gold plans have lower co-insurance percentages.

For instance, if your Silver plan has a 70/30 co-insurance, Cigna will cover 70% of the allowed amount for your covered services, while you’ll be responsible for the remaining 30%.

Be sure to familiarize yourself with your plan’s co-insurance terms to understand your share of the costs for drug treatment services.4

The out-of-pocket max is the maximum you’ll have to pay for covered drug treatment services in a given plan year. This limit provides important financial protection, ensuring that once you’ve reached it, your Cigna plan will cover 100% of the allowed amount for your covered services for the remainder of the plan year.

The out-of-pocket max is typically lowest for Gold plans and highest for Bronze plans. Your deductible, coinsurance, and copayments for covered services typically count toward your out-of-pocket max.

Premiums, balance billing charges from out-of-network providers, and costs for non-covered services generally don’t apply. Knowing your plan’s out-of-pocket max can help you understand the upper limit of your financial responsibility for drug treatment in a given year.

Cigna categorizes its plans into metal tiers (Bronze, Silver, and Gold) to indicate the overall cost-sharing structure. Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs, while Gold plans have higher premiums but lower out-of-pocket expenses. Choosing a plan that aligns with your healthcare needs and financial situation.

Cigna Approval Process for Treatment

The first step before beginning drug treatment is to verify your Cigna coverage. The treatment center you choose will contact Cigna to confirm that you have an active policy and determine the specifics of your coverage for their services.

This process helps the treatment center understand your plan’s deductible, coinsurance, out-of-pocket max, and any prior authorization requirements or limitations on covered services.

Once verification is complete, the treatment center will inform you of any estimated out-of-pocket expenses you may be responsible for, giving you a clearer picture of your treatment’s financial aspect.

To expedite the verification process, you can use our convenient verify insurance tool to provide the necessary information to your chosen treatment center quickly.

After you receive drug treatment services, the treatment center will submit claims to Cigna on your behalf. This is a standard practice among treatment providers, as they have the expertise and resources to handle the billing and claims process.

The treatment center will provide Cigna with detailed information about the services you received, including dates of service, procedure codes, and diagnostic codes.

By having the treatment center submit claims directly to Cigna, you can focus on your recovery without the added stress of navigating the claims process yourself.

Once Cigna receives the submitted claims from your treatment center, they will review the information to determine if the services are covered under your plan and meet the necessary medical criteria. This process is called adjudication.

Cigna will consider factors such as your plan’s benefits, any prior authorization requirements, and the medical necessity of the services provided. Based on these factors, they will decide whether to approve or deny the claims.

If your claims are approved during adjudication, Cigna will pay the treatment center according to your plan’s coverage terms.

The treatment center will receive the allowed amount for the covered services minus any deductible, co-insurance, or copayment amounts that are your responsibility.

If you have already paid any out-of-pocket expenses, the treatment center will apply the Cigna payment to your account and issue you a refund if applicable.

If Cigna denies any of your claims for drug treatment services, your treatment center will likely file an appeal on your behalf.

Treatment centers have experienced billing departments that are well-versed in the appeals process and will work diligently to get the denied services covered.

They will gather additional information, such as medical records and doctor’s notes, to support the medical necessity of the services provided and submit this information to Cigna for reconsideration.

It’s important to note that treatment centers strive to provide only services they believe will be covered by insurance. Still, if your insurance is denied, they will advocate for you in the appeals process to ensure you receive the maximum coverage possible.

Get Help Paying Your Deductible

File a Hardship With Cigna

If you’re struggling to pay your deductible for drug treatment, you may be able to file a hardship with Cigna. A hardship is a situation that prevents you from affording your out-of-pocket expenses, such as a job loss, medical emergency, or other unexpected financial strain. To file a hardship, you must contact Cigna directly and provide documentation of your financial situation. Cigna will review your case and may be able to offer assistance, such as a payment plan or a temporary reduction in your out-of-pocket costs. Remember that hardship assistance is not guaranteed and is determined case-by-case.

Assistance Programs & Payment Plans

Many drug treatment centers offer assistance programs and payment plans to help you manage your out-of-pocket expenses, including your deductible. These programs may include sliding-scale fees based on your income, scholarships, or grants. Some treatment centers also offer in-house financing options or work with third-party lenders to provide payment plans that allow you to spread your deductible and other out-of-pocket costs over time. When you’re considering a treatment center, be sure to ask about any financial assistance options they may have available.

Community Resources & Charitable Organizations

Community resources and charitable organizations, such as local faith-based groups, community foundations, and national non-profits focused on addiction recovery, may be able to help cover your deductible for drug treatment. These organizations understand the importance of timely care. Your treatment center or local health department may have information on these resources, but remember that they may have limited funds and eligibility requirements. Don’t let financial concerns stop you from seeking the drug treatment you need.

FAQs About Using Cigna Benefits to Pay for Alcohol and Drug Treatment

Does Cigna cover inpatient and outpatient drug treatment?

Cigna offers comprehensive coverage options for both inpatient and outpatient programs:

- Inpatient Treatment: This includes medically supervised detoxification, residential treatment, and intensive medical care for individuals with severe addiction or those who need 24-hour supervision. Inpatient programs provide a structured environment and may last from a few weeks to several months, depending on the individual’s recovery progress.

- Outpatient Treatment: These programs are suitable for individuals who prefer to continue their daily activities while receiving treatment. Outpatient care includes group therapy, one-on-one counseling, and educational sessions. It’s ideal for those who can maintain sobriety in their home environment and require flexibility in their treatment schedule.

- Residential Treatment: This type of program provides a drug-free and alcohol-free environment where individuals can focus on their recovery without outside distractions. It typically involves group therapy, individual counseling, medical care, and sometimes job or career training. Residential treatment is beneficial for those who have struggled with addiction for a long time or have legal issues related to substance use.

Will I need prior authorization for drug treatment services?

In many cases, yes.

Cigna typically requires prior authorization for inpatient drug treatment services and some outpatient services to ensure the care provided is medically necessary and appropriate.

The prior authorization process involves a review by Cigna to determine whether the proposed treatment aligns with their medical necessity guidelines.

Here’s how it generally works:

- Initial Assessment: Your chosen treatment center will perform an initial assessment to develop a treatment plan. This plan includes details about your condition, the proposed treatment, and the anticipated length of stay or number of sessions needed.

- Submission for Authorization: The treatment center will then submit the treatment plan, along with any clinical information and supporting documentation, to Cigna for review. This documentation may include medical records, a history of prior treatments, and a rationale for the recommended level of care.

- Review by Cigna: Cigna’s clinical team reviews the submitted information to determine if the treatment meets their criteria for medical necessity. This review process helps ensure that the proposed care is appropriate for your specific situation and that it follows best practices in addiction treatment.

- Authorization Decision: If Cigna approves the request, they will provide authorization for the treatment to proceed. This approval usually specifies the duration and extent of the coverage. If additional treatment is needed beyond the initially authorized period, the treatment center may need to submit a request for an extension.

- Denial and Appeals: If Cigna denies the prior authorization request, they will provide a reason for the denial. You and your treatment provider have the option to appeal the decision by providing additional information or evidence to support the need for the treatment.

- Importance of Prior Authorization: Obtaining prior authorization is crucial because if it is not secured when required, your claims may be denied. This means you could be held financially responsible for the full cost of the treatment. Ensuring that prior authorization is obtained helps avoid unexpected out-of-pocket expenses and ensures that your treatment is covered under your plan.

Can I go to an out-of-network treatment center with my Cigna plan?

The ability to use out-of-network providers depends on your specific Cigna plan type.

Some plans, like PPO and POS plans, offer coverage for out-of-network care, although you may face higher out-of-pocket costs, such as increased coinsurance or deductibles.

Other plans, like HMOs and EPOs, typically do not cover out-of-network treatment except for emergencies.

If you prefer a specific out-of-network treatment center, it’s crucial to contact Cigna to understand your coverage and any potential financial implications.

In some cases, you may be able to negotiate a single-case agreement with Cigna and the treatment center to receive in-network coverage for your care.

Remember, while these are common questions, the specific answers can vary based on your Cigna plan and circumstances.

Always refer to your plan documents and contact Cigna customer service for personalized guidance on your drug treatment coverage.

Sources

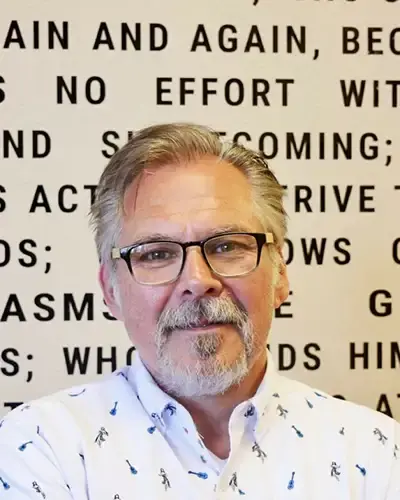

CLINICALLY REVIEWED

Lionel Estrada, LISAC

CLINICAL DIRECTOR

Lionel, our Clinical Director is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone, specializes in addiction and mental health. Trained in EMDR therapy, he employs a trauma-informed, empathetic approach to address the underlying causes of these issues.

- Read our Editorial Policy

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.

Get Started

Now

Call and speak with one of our caring team members about help for you or a loved one.