Cornerstone

GEHA SUBSTANCE ABUSE TREATMENT

Learn about Government Employee Health Association substance abuse treatment coverage and get help at our Arizona rehab centers that accept GEHA's plans

GEHA DRUG TREATMENT COVERAGE

Understanding your healthcare options is the first step toward recovery, and the Government Employee Health Association’s coverage for drug rehab could be the key to accessing the care you need.

Here at Cornerstone Healing Center, we’re proud to accept GEHA insurance, which allows us to provide our extensive substance abuse treatment programs to those in need.

Our dedication lies in offering personalized, high-quality care that merges evidence-based methods with holistic therapies. This integrated approach promotes healing and equips you for a sustained recovery.

Let us guide you through the details of your GEHA coverage, showcase our programs, and demonstrate how we can work together to build a healthier future for you, free from substance dependency.

Jump to the following sections

View our addiction treatment locations

Addictions we treat at Cornerstone

GEHA COVERED DRUG REHAB PROGRAMS

Our Residential Treatment Programs provide comprehensive and continuous support for individuals struggling with substance abuse. Our method integrates evidence-based therapies, including Cognitive-Behavioral Therapy (CBT) and Dialectical Behavior Therapy (DBT), with holistic recovery approaches such as detoxification, counseling, mindfulness, yoga, and nutritional education. We aim to help individuals overcome the underlying causes of addiction and provide them with the necessary skills to achieve lasting recovery and prevent relapse.

Our Partial Hospitalization Programs (PHP) for substance abuse provide a structured and comprehensive route toward recovery. Available five days a week for six hours daily, our PHP features intensive daytime care, including therapy, group meetings, and holistic practices, eliminating the necessity for overnight stays. This approach enables individuals to address and navigate their addiction challenges while arming them with vital skills and support needed for long-term sobriety. By promoting accountability and encouraging the application of learned strategies in daily life, our PHP helps participants move forward in their recovery journey.

Our Intensive Outpatient Program (IOP) begins the treatment pathway, succeeded by our regular Outpatient Program, and operates three days a week, with scheduling flexibility to accommodate individual responsibilities and commitments. These Outpatient Programs encompass diverse therapeutic approaches, including individual counseling, group therapy sessions, and workshops aimed at developing skills. Through our holistic approach, we facilitate a supportive path to recovery and rebuilding lives affected by addiction.

GEHA HEALTH INSURANCE

GEHA (Government Employees Health Association) is a renowned healthcare provider that offers health and dental plans to federal employees, retirees, and their families. Since its establishment in 1937, they cater to the healthcare needs of postal workers and has expanded its services to millions of federal employees throughout the United States.1 With its extensive range of comprehensive health insurance options, Government Employee Health Association offers various plans that meet the diverse needs of the federal workforce while focusing on preventative care, wellness programs, and providing extensive coverage. GEHA’s unwavering commitment to serving government employees has made it a trusted name in health insurance for the federal community.

ABOUT GEHA DRUG TREATMENT COVERAGE

GEHA insurance provides comprehensive coverage for individuals seeking treatment for substance abuse and alcohol addiction.2 They understand the significance of access to comprehensive care for an effective recovery. Their plans usually cover many services, such as detoxification, inpatient and outpatient rehabilitation programs, therapy sessions, and support groups. GEHA is committed to supporting its members throughout their recovery journey by integrating evidence-based practices and holistic approaches. Their approach to treating addiction is dedicated to health and wellness, providing the care and attention required for effective treatment.

Alumni Client Family Testimonial

I feel like Cornerstone gave him all the right tools. He knew how to do it. It was something we could have never done. I just could totally see kind of a personality change in him of wanting, and knowing, that he could achieve and do higher things and greater things. That has to be the people (at Cornerstone).”

Nicole A. - Mother of a Cornerstone Alumni

What Addictions Does GEHA Provide Coverage For?

Addictions Treatment Covered

GEHA insurance provides extensive coverage for substance abuse disorders, encompassing treatments for alcohol and drug rehabilitation. Our Arizona facilities offer a range of treatments likely covered by your health insurance, including:

- Alcohol: GEHA insurance supports holistic recovery programs for alcohol addiction.

- Opioids: Comprehensive care and assistance for overcoming opioid addiction are available.

- Fentanyl: GEHA insurance includes coverage for fentanyl addiction treatment, offering specialized care and support.

- Cocaine: Specialized treatment covers plans to address cocaine dependency and promote lasting sobriety.

- Methamphetamine: Insurance supports effective recovery from meth addiction by focusing on fundamental aspects of treatment.

- Benzodiazepine: Programs targeting benzodiazepine withdrawal and rehabilitation are covered under insurance.

- Co-Occurring Disorders: GEHA provides coverage for customized therapy for those dealing with concurrent addiction and mental health issues.

Programs We Offer

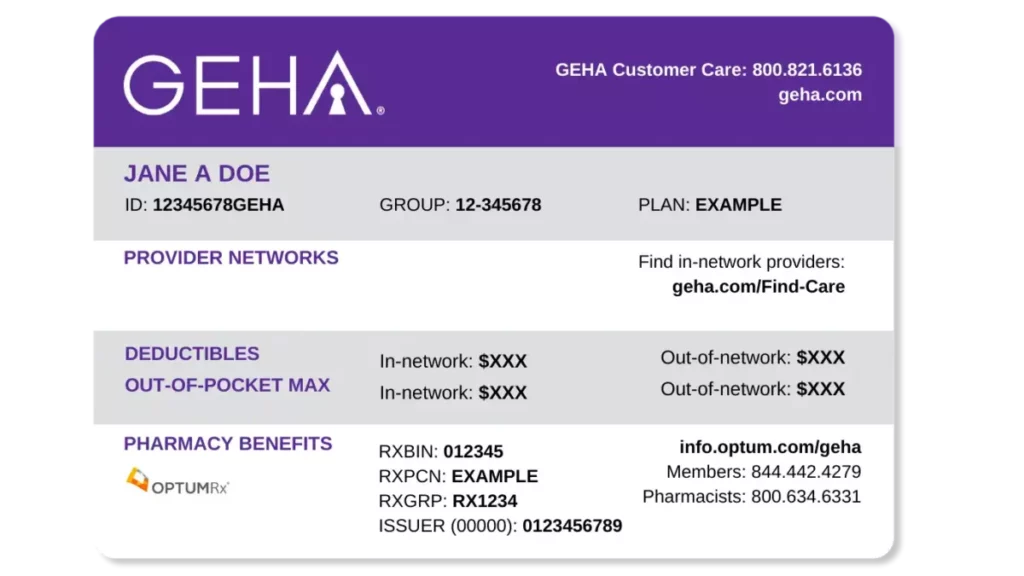

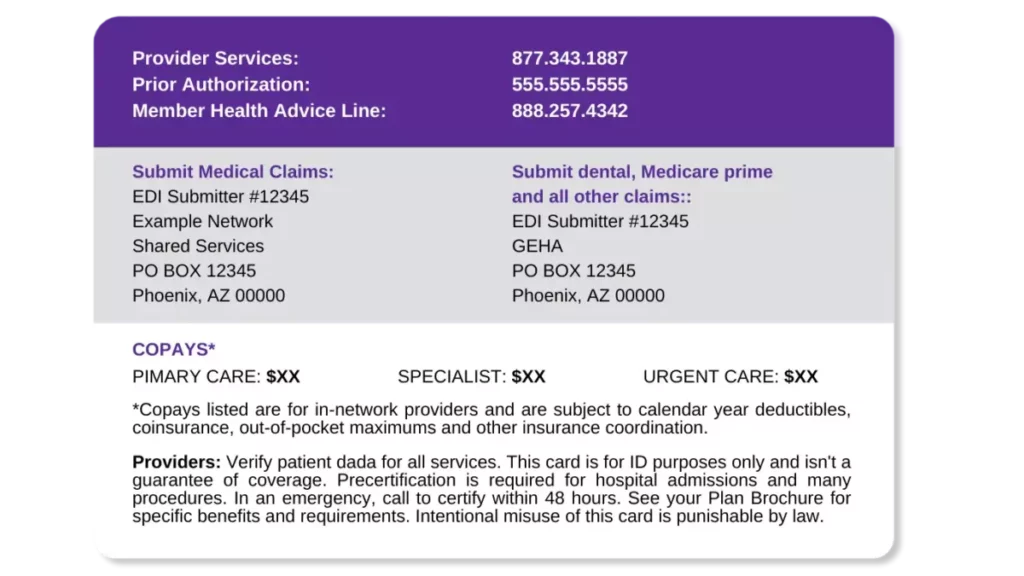

Understanding Your Insurance Card

Card Front

Card Back

Meet Our Clinical Team

Clinical Director of Scottsdale Program

Lionel is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone. Passionate about helping those with addiction and mental health struggles, and he has trained as an EMDR therapist, adopting a trauma-informed approach to find and treat underlying root causes with empathy.

Clinical Director of Phoenix Program

Nate began his recovery journey in 2010 and earned a Master’s in Social Work from ASU. He’s been in the Behavioral Health field since 2013. Specializing in CBT, DBT, and grief, Nate is now the Clinical Director of our Phoenix program, underlined by his passion for helping others who struggled with substance abuse issues as he did.

FAQs About GEHA

Get answers to the most commonly asked questions about rehab coverage.

What types of rehab programs does GEHA cover?

Coverage for drug and alcohol rehabilitation under GEHA insurance varies depending on your plan’s details.

Still, many policies broadly support a spectrum of treatment options aiding members on their path to recovery.

Consulting your plan’s Summary of Benefits and Coverage (SBC) is crucial for obtaining precise information about what your policy covers.

Our team can assist in this process through our insurance verification service.

Typically, GEHA insurance may encompass treatments such as:

- Detoxification: Medical detox assists in safely managing withdrawal from substances with medical oversight.

- Residential Treatment: Offers a live-in structured setting for comprehensive care, including therapy and medical supervision.

- Partial Hospitalization Programs (PHP): PHPs provide intensive care for several hours daily, permitting patients to spend evenings at home.

- Intensive Outpatient Programs (IOP): IOPs deliver outpatient care with more intensity than standard programs, often involving treatment for several hours across multiple days weekly.

- Outpatient Programs: These programs involve therapy and counseling sessions for a few hours weekly, enabling ongoing daily life activities alongside treatment.

- Therapy Sessions: Coverage often extends to various therapy formats, including individual, group, and family sessions, targeting addiction’s psychological and emotional facets.3

- Aftercare and Recovery Support Services: Some GEHA plans may include aftercare services such as recovery coaching, offering continued connection and support post-treatment.

What types of addictions does GEHA cover treatment for?

GEHA provides two insurance plans, each covering addiction and substance abuse treatment.

Eligibility for treatment is based on specific criteria, and it’s important to identify the particular type of rehabilitation needed.

Covered addictions under GEHA insurance include:

*Cornerstone offers treatment for these and other substance abuse issues.

Coverage for Dual-Diagnosis or Co-occurring Disorders Under GEHA

Mental health challenges often accompany addiction.

The link between deteriorating mental health and substance abuse is significant, as poor mental health may drive some to seek relief through substances, or chronic substance use may alter brain chemistry, leading to mental health disorders.

Recognizing substance abuse disorder as a mental health condition, GEHA covers a wide array of behavioral therapies under its health insurance plans.

Individuals seeking mental health support can access it both within and outside of rehabilitation settings.

While GEHA supports numerous therapeutic approaches, it’s vital to ensure the available programs match your specific needs and treatment goals.

This is essential for holistic recovery and mental well-being.

How much will I pay out of pocket for treatment?

Federal regulations require all insurance providers, including GEHA, to provide coverage for essential services.

While coverage for different treatments may vary, substance abuse and mental health services are considered essential and are therefore covered by GEHA.

Additionally, GEHA has set a maximum limit on the amount members need to pay out-of-pocket annually by imposing a cap on deductibles, which is great news for policyholders.

How do I find out my coverage?

Coverage for drug rehab under GEHA is contingent upon the specific duration and type of treatment chosen.

For instance, if a client is eligible for a 30-day alcohol rehab program, GEHA will probably provide coverage.

Typically, GEHA offers coverage for up to six weeks of inpatient rehab and twelve weeks for intensive outpatient programs.

Furthermore, the insurer ensures the treatment is medically necessary and may offer extended coverage in critical situations.

Managing Out-of-Pocket Expenses

The insurance plan you select is crucial in determining your out-of-pocket expenses.

Opting for a premium healthcare experience, such as a luxury rehab resort, may incur costs outside your coverage.

GEHA identifies which services, medications, and treatments are eligible for coverage under your plan.4

Consequently, those enrolled in High Option or HDHP (High Deductible Health Plans) are less likely to face additional charges, as these plans offer comprehensive coverage.5

On the other hand, standard plans may require higher deductibles.

Even though GEHA sets a deductible limit, paying thousands of dollars yearly before insurance coverage starts can be a significant financial burden for some people.

The deductibles must be fulfilled before coverage can be activated.

To fully understand your GEHA insurance benefits, contact us for a complimentary and private insurance verification.

We’ll provide a detailed explanation of your coverage.

How do I read my GEHA insurance card?

Understanding the details on your GEHA Insurance card is crucial, as it contains the necessary information for submitting an insurance verification with GEHA.

- Member Name: Displays the cardholder’s name. It’s important to verify that it accurately reflects your name to prevent discrepancies or issues during medical services.

- Member ID: A unique code given to each member, essential for healthcare providers to access when providing services or submitting claims on your behalf.

- Group Number: This number identifies your specific insurance plan or group, sometimes referred to as “Policy Number” or “Plan Number.”

- Plan Type: Indicates whether you have a Fee-for-Service (FFS) plan with a Preferred Provider Organization (PPO), High-Deductible Health Plan (HDHP), or another plan type.

- Provider Network: You may specify the network associated with your plan, which aids in identifying in-network healthcare providers and facilities.

- Co-payment Information: Lists fixed payment amounts for particular services such as doctor visits or prescriptions, providing a quick reference for out-of-pocket costs.

- Customer Service Phone Number: This number offers a direct line to GEHA customer service for inquiries or assistance with insurance questions.

- Claims Address: The designated mailing address for healthcare providers to submit claims for the cost of services rendered to you.6

Having this information at your fingertips can streamline receiving medical care and handling insurance matters.

Sources

[1] About | GEHA

[2] Alcohol Awareness and Treatment Options | GEHA

[3] Tune in to your Mental Health | GEHA

[4] Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services | GEHA

[5] A Fee-for-Service High Deductible Health Plan Option with a Preferred Provider Organization | GEHA

CLINICALLY REVIEWED

Lionel Estrada, LISAC

CLINICAL DIRECTOR

Lionel, a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone, specializes in addiction and mental health. Trained in EMDR therapy, he employs a trauma-informed, empathetic approach to address underlying causes of these issues.

- Read our Editorial Policy

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.

Get Started

Now

Call and speak with one of our caring team members about help for you or a loved one.