Cornerstone

Understanding Health Choice Drug Treatment Coverage

Learn about using your Health Choice insurance policy to cover substance abuse treatment

Alcohol and Drug Treatment Coverage with Health Choice

If you or a loved one is struggling with addiction, finding the right treatment can be overwhelming.

However, your health insurance through Health Choice can offer essential support during this difficult time.

This guide will explain what your Health Choice plan covers for alcohol and drug treatment, including network inclusions, navigating the claims process, different plan options, and understanding your deductibles.

The path to recovery is challenging, but your Health Choice coverage makes it more manageable at every step.

View our addiction treatment locations

Addictions we treat at Cornerstone

Health Choice drug treatment coverage

In-Network

Out-of-Network

When you choose an In-Network treatment provider through Health Choice, you’ll typically enjoy the highest level of coverage and lowest out-of-pocket costs. In-network providers have contracted rates with Health Choice, so you won’t be hit with unexpected charges or worry about surprise bills. The claims process is streamlined when you stay in-network, requiring less paperwork. However, your options may be more limited compared to going out-of-network. It’s essential to research the in-network facilities in your area to ensure they offer the specific type of treatment and level of care you need.

Health Choice AZ does not cover out-of-network treatment, although sometimes they will give an exception for emergency care.

Information about Health Choice Plan Types

Health Maintenance Organization (HMO)

With a Health Choice HMO plan, you must select a primary care physician (PCP) who will coordinate your care, including referrals to specialists. HMOs generally have lower monthly premiums but require you to stay within the plan’s network of providers to receive full coverage.

Preferred Provider Organization (PPO)

Health Choice PPO plans offer more flexibility, allowing you to see out-of-network providers, though you’ll pay more for that privilege. PPOs have a network of preferred providers where you’ll spend less, but you don’t need a referral to see a specialist. This plan is ideal for those who want the freedom to choose their healthcare providers while managing costs.

Exclusive Provider Organization (EPO):

An EPO plan is similar to an HMO, but you don’t need a referral to see a specialist within the plan’s network. You won’t receive coverage for out-of-network care except in emergencies. This plan offers flexibility in choosing specialists while maintaining lower costs by staying within the network.

Point of Service (POS)

A POS plan combines elements of both HMOs and PPOs. You’ll need to select a PCP, but you can visit out-of-network providers, though you’ll pay more for that care. This type of plan balances cost savings and flexibility, allowing you to choose the best care options for your needs while managing expenses.

High Deductible Health Plan (HDHP)

Health Choice HDHPs have lower monthly premiums but require you to pay a higher deductible before coverage kicks in. These plans are often paired with a health savings account (HSA) to help cover out-of-pocket costs.

Medicaid & Medicare Plans

Health Choice offers comprehensive Medicaid and Medicare plans tailored to each program’s requirements. The Medicaid AHCCCS plan features a $0 or $43.20 monthly premium, no deductible, and a maximum out-of-pocket of $7,550 per year if eligibility is lost. This plan provides full coverage, including $0 copays for inpatient hospital stays and outpatient services.

Understanding Policy Terminology

Your deductible is the amount you must pay out-of-pocket for covered services before your Health Choice plan starts paying. For example, if your deductible is $500, you must cover the first $500 medical expenses before your plan kicks in. Deductibles can vary significantly between plan types, so review this carefully when selecting coverage.

After you meet your deductible, your plan will start sharing the costs through co-insurance. You’ll pay a percentage for covered services; your plan will cover the rest. A typical co-insurance rate might be 80/20, meaning your plan pays 80%, and you pay 20% of the costs.

Once you reach your out-of-pocket maximum, your Health Choice plan will cover 100% of your covered medical expenses for the rest of the plan year. This protects you from unlimited costs if you need extensive treatment. Understanding these terms helps you choose the right plan and manage your treatment costs.

Health Choice Approval Process for Treatment

When you choose a treatment center, they will verify your coverage with Health Choice to determine the specifics of your plan, including your deductible, co-insurance rates, and out-of-pocket maximum. This allows the treatment center to inform you of your financial responsibility for the services you need, ensuring you are fully informed and can plan accordingly. Verify your Health Choice coverage with us today to start your recovery journey.

The treatment center typically handles the claims submission process on your behalf. They gather the necessary documentation and codes and submit the claim directly to Health Choice, streamlining the process and reducing your administrative burden during this difficult time.

Adjudication is when Health Choice reviews a submitted claim to determine if the services are covered under your plan. They evaluate the claim details, such as the treatment type, provider, and dates of service, to ensure alignment with your benefits. Once approved, Health Choice applies your plan specifics, like deductibles and co-insurance, to calculate the payment amount. For example, with a $500 deductible and 20% co-insurance, they determine their payment and your responsibility.

If the claim is approved after adjudication, Health Choice will submit payment for their portion directly to the treatment center. You’ll then be responsible for paying any remaining balance, such as your deductible or co-insurance amount.

If your claim is denied, the treatment center’s billing department will likely file an appeal on your behalf. At Cornerstone, we are experienced in navigating the appeals process to ensure your Health Choice plan covers medically necessary services. The approval process aims to provide you with the coverage and support needed during addiction treatment. By working closely with your treatment center, you can focus on recovery while they manage the insurance logistics.

FAQs About Using Health Choice Benefits

to Pay for Alcohol and Drug Treatment

What levels of care will Health Choice cover?

Health Choice Insurance (of Arizona) provides coverage for various care levels to meet the diverse treatment needs of our members.1

Depending on the individual plan, coverage can include:

- Outpatient Treatment: Offers weekly therapy sessions and treatments, enabling individuals to stay home and keep up with their everyday activities while undergoing treatment.

- Intensive Outpatient Programs (IOP): Recognizing the importance of accessible yet profound treatment modalities, Health Choice covers IOP services. These are crucial for individuals who must balance life’s responsibilities with the recovery process, providing therapy, counseling, and group support in a flexible schedule.

- Partial Hospitalization: Delivers comprehensive day treatment, allowing individuals to spend evenings at home after receiving intensive care during the day.

- Inpatient Treatment: Provides round-the-clock care in a hospital or residential environment, tailored for those who need extensive support to overcome addiction and achieve lasting sobriety.

Factors like addiction severity, health history, and personal situation determine the appropriate care level for each member.

Through collaboration with a network of esteemed providers, Health Choice Arizona commits to offering our members access to high-quality care tailored to their recovery needs.

Does Health Choice cover Co-Occurring or Dual Diagnosis treatment?

Yes, Health Choice Arizona offers coverage for dual diagnosis treatment, encompassing both substance abuse and mental health disorders.2

Treating dual diagnosis is crucial in substance abuse recovery as it simultaneously tackles the addiction and any coexisting mental health issues that might be fueling substance use.

Such treatment typically involves a combination of therapy, medication management, and additional supportive measures aimed at addressing both the substance dependency and the mental health condition.

Insurance providers recognize the need for holistic treatment and cover various dual diagnosis treatment approaches, ensuring members access the comprehensive care required for sustained recovery.

Do I need Prior Authorization for addiction treatment?

Most insurance plans, including Health Choice, typically require prior authorization for rehab, though this depends on your specific plan and benefits.

Please get in touch with us for an insurance verification so we can review the details of your plan and start the process of getting you into treatment today.

What if Health Choice denies my claim for addiction treatment?

If Health Choice denies your claim for addiction treatment, Cornerstone will file an appeal on your behalf.

Our knowledgeable team is dedicated to ensuring you receive approval and access to treatment as quickly as possible.

Verify your insurance with us today so we can get you into treatment!

Sources

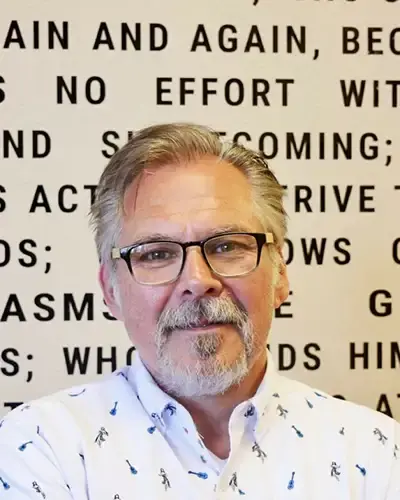

CLINICALLY REVIEWED

Lionel Estrada, LISAC

CLINICAL DIRECTOR

Lionel, our Clinical Director is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone, specializes in addiction and mental health. Trained in EMDR therapy, he employs a trauma-informed, empathetic approach to address the underlying causes of these issues.

- Read our Editorial Policy

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.

Get Started

Now

Call and speak with one of our caring team members about help for you or a loved one.