Cornerstone

Understanding Meritain Health Drug Treatment Coverage

Learn about using your Meritain Health insurance policy to cover substance abuse treatment

Alcohol and Drug Treatment Coverage with Meritain Health

Seeking help for alcohol or drug addiction is a courageous step, and having the right health insurance coverage can make all the difference in accessing quality treatment. If you are covered by Meritain Health, a subsidiary of Aetna and CVS, it’s essential to understand how your plan supports your recovery journey.

Meritain Health is a third-party administrator (TPA) that offers a variety of health insurance plans to over 1.5 million members across the U.S. These plans include self-funded plans, traditional provider network plans, consumer-directed health plans, and value-based benefit designs. Meritain Health also provides Medicare Part D coverage.1

The guide below explains Meritain’s network coverage, the claims approval process, the types of plans available, deductibles, and how to navigate financial hardships.

Jump to the following sections

Addictions we treat at Cornerstone

Meritain Health drug treatment coverage

In-Network

Out-of-Network

When seeking drug treatment with Meritain Health, choosing an in-network provider can offer significant advantages. In-network treatment centers have negotiated rates with Meritain, which often translates to lower out-of-pocket costs.2

For outpatient treatment, groups of 50 or fewer members have a plan covering the deductible and 50% coinsurance, with a limit of 40 visits per year. For groups over 50, the plan follows the chosen copay, deductible, and coinsurance options.

Inpatient treatment for groups of 50 or fewer applies to the deductible and 50% coinsurance, with a limit of 30 days per plan year. Groups over 50 follow the selected deductible and coinsurance options.

Remember that while Meritain has vetted in-network providers for quality, the selection of treatment centers may be more limited compared to out-of-network options.3

Opting for an out-of-network treatment center with Meritain Health provides a wider range of choices. You can select a facility specializing in your addiction or offering a preferred treatment approach. However, this flexibility comes with potential drawbacks.

For outpatient treatment, groups of 50 or fewer have a plan covering the deductible and 30% coinsurance, with a limit of 40 visits per year. For inpatient treatment, the same group size covers the deductible and 30% coinsurance, with a limit of 30 days per plan year.

Out-of-network providers may have higher costs, and Meritain might cover a smaller portion of the expenses, leaving you with higher out-of-pocket responsibilities. You may need to handle more of the claims process, which can be time-consuming and complex. Consider the benefits and potential financial implications when choosing an out-of-network treatment center.

Information about Meritain Health Plan Types

Health Maintenance Organization (HMO)

Meritain Health’s HMO plans offer a network of healthcare providers that members must use to receive coverage.

This plan type typically requires a primary care physician (PCP) to coordinate care and provide referrals to specialists.

HMOs often have lower premiums and out-of-pocket costs than other plan types but offer less flexibility in provider choice.

Preferred Provider Organization (PPO)

Meritain Health’s PPO plans offer a balance between flexibility and cost-effectiveness.

They allow members to choose healthcare providers in and out of the network and see specialists without a PCP referral.

Understanding the plan options, including stop-loss provisions, deductibles, coinsurance, and out-of-pocket maximums, which may vary by state, is essential.

Exclusive Provider Organization (EPO)

Meritain Health’s EPO plans blend features of HMOs and PPOs.

Like HMOs, EPOs require members to use in-network providers for coverage, except in emergencies.

However, like PPOs, EPOs typically don’t require referrals from a PCP to see a specialist.

EPOs often have lower premiums than PPOs but less flexibility than HMOs.

Point of Service (POS)

Meritain Health’s POS plans combine aspects of HMOs and PPOs.

Members can choose between in-network and out-of-network providers, but using in-network providers results in lower out-of-pocket costs.

A PCP is required, and they must provide referrals for specialist care.

POS plans offer more flexibility than HMOs but may have higher premiums and deductibles.

High Deductible Health Plan (HDHP)

Meritain Health’s HDHPs feature lower premiums but higher deductibles than other plan types.

These plans are often paired with a Health Savings Account (HSA), allowing members to save tax-free money for medical expenses.

Once the deductible is met, the plan pays a percentage of covered services.

Medicaid & Medicare Plans

Meritain Health offers plans alongside Medicaid and Medicare for eligible individuals.

These plans help to lower out-of-pocket costs and expand access to healthcare services. Eligibility depends on age, income, and disability status.

Due to the Affordable Care Act, these plans must cover some addiction and mental health treatment programs, with coverage details varying by plan and location.

Understanding Policy Terminology

Deductible

Co-Insurance

Out-of-Pocket Max

A deductible is the amount you must pay out of pocket for covered healthcare services before your insurance plan begins to pay its portion.

Meritain Health offers a range of deductible options for its plans, with individual deductibles ranging from $500 to $8,550.

Some options, such as $1,500, $2,000, $2,500, $2,800, $3,000, $3,500, and $5,000, are compatible with Health Savings Account (HSA).

Family deductibles are typically twice the individual amount.

Once you’ve met your deductible, your insurance will start covering some of the costs outlined in your plan’s co-insurance.

Co-insurance is the percentage of covered healthcare costs you pay after meeting your deductible.

Your Meritain Health plan covers the remaining percentage.

Meritain Health plans offer co-insurance splits of 100%, 90%/10 %, 80%/20 %, or 70%/30%.

When you select the non-preferred prescription drug option, the insured’s co-insurance responsibility for 90%/10 %, 80%/20 %, and 70/30 % plans increases by 20%.

Co-insurance continues until you reach your out-of-pocket maximum.

You must pay the out-of-pocket maximum each plan year, which includes your deductible, co-insurance, and copays.

Meritain Health’s out-of-pocket maximums range from $1,000 to $8,550 ($7,900 in Colorado).

Once you reach this limit, your insurance covers 100% of the allowed amounts for covered services.

Understanding these terms is crucial for comparing Meritain Health plans and managing your healthcare expenses effectively.

Get Help Paying Your Deductible

File a Hardship With Meritain Health

If you are experiencing financial difficulties that make it challenging to pay your deductible, you may be eligible to file a hardship with Meritain Health.

A hardship exemption can potentially lower your deductible or out-of-pocket expenses.

To apply, contact Meritain Health directly and provide documentation of your financial situation, such as income statements, tax returns, or medical bills.

Meritain Health will review your case and determine if you qualify.

Assistance Programs & Payment Plans

Many addiction treatment centers offer assistance programs and payment plans to help make treatment more accessible and affordable.

These programs may include sliding-scale fees based on your income, scholarships, or grants.

Some treatment centers also offer flexible payment plans that allow you to spread the cost of your deductible over a more extended period.

When researching treatment centers, inquire about their financial assistance options and how they can help you manage your deductible.

Community & Charitable Resources

Remember to explore community resources and charities that may assist in covering your addiction treatment deductible.

Organizations such as SAMHSA and NAMI provide grants, scholarships, and financial aid for those in need.

Contact Meritain Health, your treatment center, and local organizations for guidance.

By taking advantage of these options, you can make treatment more affordable and concentrate on your recovery.

Meritain Health Approval Process for Treatment

Verification

Submission

Adjudication

Payment

Appeal

Before beginning treatment, the chosen treatment center will verify your Meritain Health coverage to determine your eligibility and the specific benefits available under your plan.

They will also inform you of any out-of-pocket costs you may be responsible for, such as deductibles, co-insurance, or copays.

To verify your coverage today, please use our verification tool.

Once your coverage has been verified and you have begun treatment, the treatment center will submit claims to Meritain Health on your behalf.

This process involves providing detailed information about the services rendered, dates of treatment, and associated costs.

Having the treatment center handle the claims submission process allows you to focus on your recovery without the added stress of paperwork and administrative tasks.

Upon receiving the submitted claims, Meritain Health will review and process them to determine the eligible amount for payment.

This process, known as adjudication, involves verifying that the services provided are covered under your specific plan and that the treatment center has submitted all necessary documentation.

Meritain Health will then determine the portion of the costs they will cover based on your plan’s deductible, coinsurance, and out-of-pocket maximum.

If your claim is approved during adjudication, Meritain Health will issue payment to the treatment center according to your plan’s coverage.

The treatment center will then bill you for any remaining out-of-pocket expenses, such as deductibles or co-insurance, as determined by your plan.

If your claim is denied, our billing department will typically file an appeal for you, gathering additional documentation and justification.

Treatment centers are experienced in the appeals process and strive to provide services likely to be approved, reducing claim denials.

Communicate openly with us at Cornerstone and Meritain Health to ensure smooth treatment, maximize your benefits, and get the care you need!

FAQs About Using Meritain Health Benefits to Pay for Alcohol and Drug Treatment

What types of addiction treatment does Meritain Health cover?

Meritain Health offers a variety of plans that cover different levels of addiction treatment.

Depending on your specific plan, coverage may include:

- Inpatient Rehab: Intensive, residential treatment programs that provide 24/7 care and support.

- Outpatient Rehab: These less intensive programs allow you to live at home while attending treatment sessions during the day or evening.

- Detox: Medically supervised withdrawal management to help you safely and comfortably detox from substances.

- Medication-Assisted Treatment (MAT): The use of FDA-approved medications, such as buprenorphine or naltrexone, in combination with therapy to treat substance use disorders.

- Behavioral Therapy: Individual, group, and family therapy sessions to address the underlying causes of addiction and develop coping skills.

Verifying your specific coverage with Meritain Health or your chosen treatment center is essential to understanding which services are covered under your plan.

How can I find an in-network addiction treatment center that accepts Meritain Health insurance?

To find an in-network addiction treatment center that accepts Meritain Health insurance, you can:

- Use the Meritain Health online provider search tool: Visit the Meritain Health website and use the “Find a Provider” tool to find in-network addiction treatment centers.

- Contact Meritain Health directly: Call the customer service number on the back of your insurance card and ask for assistance in finding an in-network treatment center.

- Work with a treatment center’s admissions team: Many treatment centers have admissions specialists who can verify your insurance coverage and help you determine if they are in-network with Meritain Health.

Choosing an in-network treatment center can help you maximize your insurance benefits and minimize out-of-pocket costs.4

What should I do if Meritain Health denies my claim for addiction treatment?

If Meritain Health denies your claim for addiction treatment, don’t panic.

You have options:

- Review the reason for the denial: Carefully read Meritain Health’s explanation of benefits (EOB) to understand why your claim was denied.

- Contact your treatment center: Inform your billing department about the denial. They have experience dealing with insurance companies and can help you navigate appeals.

- File an appeal: Work with your treatment center to gather the necessary documentation and submit an appeal to Meritain Health. Follow the appeals process outlined in your plan documents and meet all deadlines.

- Seek external review: If your appeal is denied, you may be able to request an external review by an independent third party.

- Consider alternative funding options: If your appeal is unsuccessful, explore other ways to pay for treatment, such as payment plans, scholarships, or financial assistance programs.

Remember, claim denial is not the end of the road.

By working with your treatment center and advocating for yourself, you can fight for the coverage you need to access quality addiction treatment.

Sources

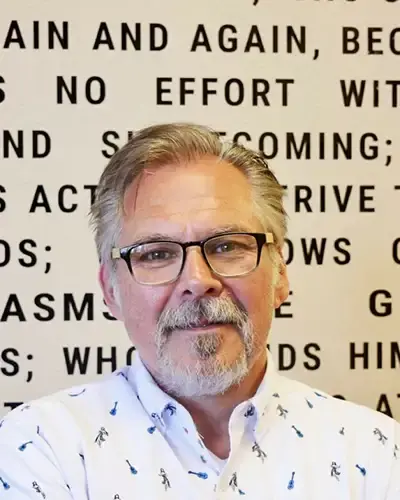

CLINICALLY REVIEWED

Lionel Estrada, LISAC

CLINICAL DIRECTOR

Lionel, our Clinical Director is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone, specializes in addiction and mental health. Trained in EMDR therapy, he employs a trauma-informed, empathetic approach to address the underlying causes of these issues.

- Read our Editorial Policy

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.

Get Started

Now

Call and speak with one of our caring team members about help for you or a loved one.